What does it take to enhance your credit report? The alternative of preparing your financial resources and sticking to a repaired strategy is constantly a wise relocation. However, that is something that each and every individual and organization entity worldwide is going to do. How do you think you can enhance your credit history and credit report much faster?

This report will tell you nothing about what a loan provider would consider you if you went in to get a mortgage or brand-new vehicle loan. Just a credit score report from the 3 credit bureaus TransUnion, Experian, Equifax can precisely offer you the info. Due to the fact that you have a high debt ratio, that report will not specify if your score may be low. When you go to a lender they will pull your report however what they are most interested in is the credit score. If you will get the loan but likewise whether or not you get the best interest rates as well, that number figures out not just.

In order to remove late payments on your credit report your have a couple of alternatives. Number one, you might do it yourself or second, you could let a creditable credit repair business with an A+ rating with the Better Business Bureau help you while doing so. With numerous business how do you understand which credit remediation company is best for you. First, you desire a company that is out there working hard for your dollar and delivering on the services they guarantee. Some business offer "low expense regular monthly choices" but it generally ends up costing you more cash in the long run due to the fact that the company contests only one product at a time.

Early detection is the secret for stopping these activities. There is credit monitoring services at a minimal month-to-month charge. They notify their customer as quickly as there is a modification in their credit report. Modifications could be a new search on their customer by a card company, brand-new loan application or brand-new payment established. The recipient of service can inspect his credit report anytime and discover his score. It takes 100s of hours to arrange out any deceitful deal and might cost $100s of dollars. On top of all of it the worries and disappointments identity theft triggers.

The law needs that you can get one totally free credit report from each of the 3 credit reporting firms each year. This legislation was presented to assist stem the increase in identity theft and monetary criminality. Do not forget to print a copy of every report from each reporting company and shop them in a safe location for future use when you check your credit report online.

The fantastic thing is you can dispute credit report products by yourself, free of charge, and conserve countless dollars in seeking advice from costs. There is absolutely nothing that you can't do on your own that credit therapists can do. So take the time to find out how to quickly raise your loan ranking, and you'll conserve a great deal of cash.

Truthfully, it is a tiresome process. Individuals will not be lying if they state that in order to erase personal bankruptcy from credit report, you might have to invest a lot of your time and energy into it. Personal bankruptcy is without a doubt the hardest product to get rid of from a credit report. Frequently, individuals would say that in order for you to get rid of bankruptcy from credit report, you would need to get rid of every other bad accounts from your report.

There is a particular amount of commitment that comes with fixing and monitoring your credit report but the benefits greatly surpass the trouble. When it comes time for a big note to be gotten in into, it will be these steps that may save you money, lower your interest rate or enable you to get a credit line. Take control of your future and don't be deceived into investing numerous dollars on a credit repair scam or last minute discover identity theft protection costly patchwork job for the loan you required the other day however are still waiting to protect. Do not relax, get begun now.good luck!

It's occurred to nearly everybody I understand. One minute you have your credit card/wallet/life in hand the next it's gone. Or you examine your credit card statement and understand there are charges on it that you didn't make. Initially there's a moment of panic, and after that you leap into action. Although some actions may appear apparent, many individuals do not do whatever best credit report monitoring they should to protect themselves after their charge card has been taken.

It comes as not a surprise then that countless people need dispute credit report repair work. Society at large has actually motivated them to spend beyond their ways, and without any formal credit training they have actually complied nicely.

Take out your credit score report from the three credit bureaus. When resolving problems such as incorrect entries, evaluate and assess your report and make sure that you have a clear mind.

It's not your destiny to struggle with high interest rates for the rest of your life. Your rating is only a snap shot of your present economic strength. You can constantly deal with it and improve.

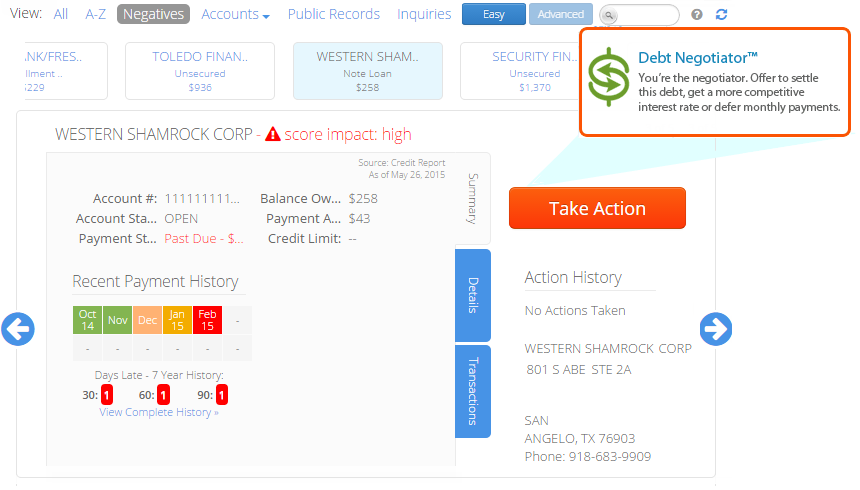

If you're not doing anything to enhance your credit rating, subscribing to a credit monitoring service is meaningless. You're paying cash every month, but for nothing. Combine credit monitoring with credit repair techniques and you'll see how well your effort is settling. For example, credit monitoring can help you see if your credit report conflict and goodwill letters were really successful in having actually the details removed from your credit report.

The FCRA states that any and every information integrated in your credit report need to be proven at any offered point of time. The credit bureau is obliged by law to eliminate the details if the lender is not in a position to confirm the same. This is end up being an extremely hassle-free loophole.

When looking for products to disagreement, these are all categories you are most likely to see and must comprehend. Account balance is the amount owed on the loan. High balance is the most you ever owed on the loan. And date of last activity (DOLA) is the last date any account activity occurred.

These are the Experian, TransUnion, and EquiFax ratings. http://edition.cnn.com/search/?text=check credit score It is also smart to pay down the balances on any arrearage that you may have. That's why you should monitor all three continually.

Try to get an installation type of loan or car loan through your bank or cooperative credit union. Get your credit report and complimentary ratings they scream with a smile. Credit repair work does not require to by puzzling.